Most major exchanges in the crypto ecosystem right now are centralized, which in many ways goes against the core philosophy of cryptocurrencies: decentralization. While there are reasons why centralized exchanges (CEX) are currently more popular than decentralized exchanges (DEX), centralization does not align with Satoshi’s original vision.

Understanding the differences between a CEX and a DEX is critical to understanding the role DEXs play in the crypto ecosystem. Exchanges enable the trading of cryptocurrencies for both digital and fiat currencies. In effect, cryptocurrency exchanges act as arbitrators between buyers and sellers and earn money primarily through commissions and transaction fees.

Centralized exchanges act as a trusted third party between a buyer and a seller and are more reliable since they are operated and controlled by a company. As of July 2022, 99% of all crypto transactions go through CEXs. Yet, they come with inherent risks; high vulnerability to hacking and high transaction fees.

To mitigate these risks, many within the crypto ecosystem see DEXs as the preferred exchanges of the future.

DEXs: How Do They Work?

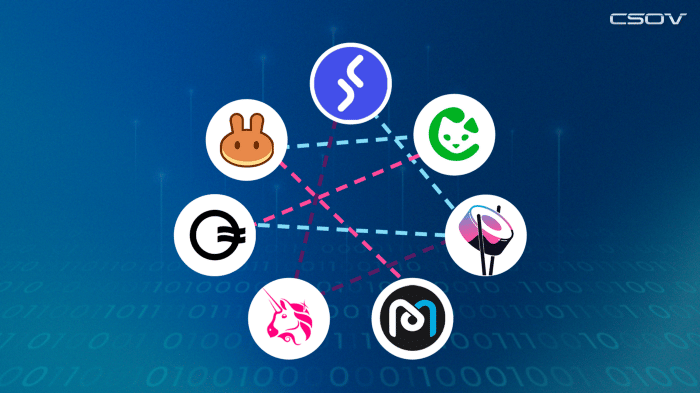

DEXs are complex smart contracts with one primary goal; to provide liquidity to crypto traders. The most significant difference between a DEX from a centralized exchange is that they do not use an order book system, a practice that has been maintained by both traditional and crypto finance for over two centuries.

DEXs use two innovations for their services; liquidity pools and automated market maker services. First, they provide liquidity pools of paired assets that a trader can use to swap. In this case, Automated Market Makers(AMMs) are smart contracts within the liquidity pools that can control the price of a particular crypto trading pair by increasing and decreasing the price based on the supply and demand of that specific asset in the market.

Liquidity pools serve a multifaceted purpose. The first one, as already discussed, provides access to decentralized liquidity. Another function of liquidity pools is giving investment opportunities to those who stake. When a user swaps assets, a small fee is charged and distributed to those providing the liquidity, thus incentivizing staking.

Importance of Decentralized Exchanges

In many ways, centralized exchanges operate in ways similar to a bank. Users can deposit their tokens on the platform, and the exchange acts as a custodian of the assets. Unfortunately, as we have seen in recent news, they are prone to hacks because there is a single point of attack that malicious actors can target. Not only do DEXs provide better security, but they also give users an avenue to control their funds.

DEXs have other substantial benefits over centralized exchanges. First, they respect a user’s privacy by not requiring KYC. Second, DEXs also allow investors, not just a centralized firm, to earn money through yield farming for anyone interested in staking.

Why Use Decentralized Exchanges

DEXs lag behind many CEXs because reaching decentralized consensus can be difficult. However, this will not always be the case. DEXs are becoming better and more accessible by the day. The evolution of Uniswap, the most prominent decentralized exchange, can map the development of DEXs. Uniswap went live in November 2018, and in February 2019, it surpassed Bancor to be the most traded AMM in the market, a position it holds to date. Fast forward to 2021, Uniswap V3 has gone live, which proposes the concept of centralized liquidity.

The reasons for using a DEX are becoming evident to many within the crypto ecosystem now; security, control over one’s funds, privacy, and financial inclusiveness. Furthermore, they promise to be a financial tool for the future, as the core of the DeFi ecosystem.

About Crown Sterling Limited LLC

Leader in Data Sovereignty and provider of quantum-secure encryption, Crown Sterling empowers individuals and communities in an era of unregulated data consolidation, monopolization, and monetization by Big Tech. By leveraging next-generation encryption, blockchain technology, and decentralized digital transformation represented by Web3, we are committed to granting you complete control over your personal data and supporting the protection of free speech, assembly and choice.

The launch of Orion™ Messenger presents a quantum-secure end-to-end encrypted, uncensorable, and decentralized communications platform as a solution where sovereign individuals and communities can thrive. Unlike commonly used applications that rely on vulnerable encryption protocols, data mining practices, and other limitations, Orion is the only platform allowing for large encrypted group chat and social media communications in an unmonitored and uncensorable environment. Join the Orion Messenger waitlist.